Which of the Following May Be a Current Liability

A long-term debt maturing currently which is to be retired with proceeds from a new debt issue c. Contingent liabilities are liabilities that may or may not arise depending on a certain event.

Solved 29 Which Of The Following May Be A Current Chegg Com

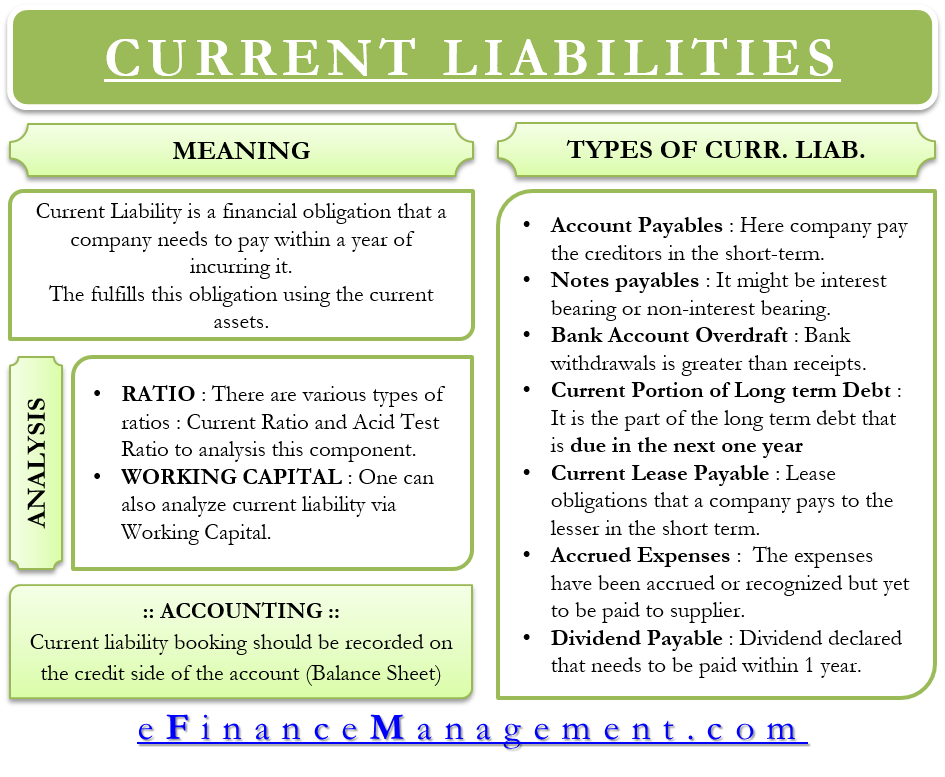

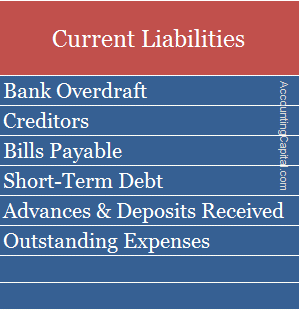

Current liabilities are defined as obligations whose liquidation is reasonably expected to a.

. Current liabilities short-term liabilities are liabilities that are due and payable within one year. If a company has too many current liabilities it may. Require use of current assets.

A long-term debt maturing currently which is to be paid with cash in a sinking fund b. Bonds to be refunded when due in 8 months there being no doubt about the. A company may exclude a short-term obligation from current liabilities if it is paid off after the balance sheet date and subsequently replaced by long-term debt before the balance sheet is issued.

Withheld Income Taxes b. A long-term debt maturing currently which is to be retired with proceeds from a new debt issue c. Bonds for which there is an adequate appropriation of retained earnings due in eleven months.

Current liability if the creditor intends to call the debt within the year otherwise a long-term liability. A company may exclude a short term obligation from current liabilities if the firm can demonstrate an ability to consummate a. This can include short-term loans accounts payable and other debts that must be paid in the near future.

Current liability if it is probable that creditor will call the debt within the year otherwise a long-term liability. Which of the following is not a current liability. Which of the following is a current liability.

Deposits Received from Customers c. A long-term debt maturing currently which is to be converted into common stock d. Require use of current assets or creation of other current liabilities.

Type of liabilities current liabilities. On April 10 2017 Coronado remitted 199820 tax to the state tax division for March. Which of the following may be a current liability.

A long-term debt maturing currently which is to be paid with cash in a sinking fund b. These are the three main classifications of liabilities. All of these answers are correct.

Which of the following items is a current liability. Current liabilities are listed on the balance sheet and are paid from the revenue generated by the operating activities of a company. Current liability if it is probable that creditor will call the debt within the year otherwise a long-term liability.

A long-term debt maturing currently which is to be retired with proceeds from a new debt issue c. Bonds for which there is an adequate sinking fund properly classified as a long-term investment due in three months. Non-current liabilities long-term liabilities are liabilities that are due after a year or more.

Bonds due in three years. Be paid within a year. Which of the following items is a current liability.

Which of the following should not be included in the current liabilities section of the balance sheet. A company may exclude a short-term obligation from current liabilities if the firm can demonstrate an ability to consummate a refinancing C. Which of the following may be a current liability.

A long-term debt maturing currently which is to be converted into common stock d. Which of the following is a current liability. Current liability if the creditor intends to call the debt within the year otherwise a long- term liability.

Which of the following items is a current liability. Bonds for which there is an adequate appropriation of retained earnings due in eleven months D. Which of the following is not a current liability.

Which of the following is not a condition necessary to exclude a short-term obligation from current liabilities. None of these answers are correct. Bonds for which there is an adequate sinking fund properly classified as a long-term investment due in three months.

Require the distribution of cash. Current liabilities are important to monitor because they can significantly impact a companys cash flow. A Withheld Income Taxes B Deposits Received from Customers C Deferred Revenue D All of these answers are correct.

Bonds due in three years. Settlement is expected within the normal operating cycle or within 12 months after the reporting date. Current liability refers to a short term obligation that has to be fulfill within 12 months while non-current liability is a long-term obligation which is to be settle in more than a.

If the amount collected is remitted to the state on or before the twentieth of the following month the retailer may keep 3 of the sales tax collected. Bonds for which there is an adequate appropriation of retained earnings due in eleven months. Where is debt callable by the creditor reported on the debtors financial statements.

A current liability is a debt that a company expects to pay within one year. Pember Corporation started business in 2012 by issuing 200000 shares. Bonds due in 3 years C.

Bonds for which there is an adequate sinking fund properly classified as a long-term investment due in 3 months B. A long-term debt maturing currently which is to be paid with cash in a sinking fund b. Bonds for which there is an adequate sinking fund properly classified as a long-term investment due in three months.

Which of the following is a current liability. Require use of current assets or creation of other current liabilities. Which of the following items is a current liability.

Examples of current liabilities include accounts payables. A long-term debt maturing currently which is to be converted into common stock d.

/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

Current Liabilities Definition

No comments for "Which of the Following May Be a Current Liability"

Post a Comment